By Dr. Omoniyi Yakubu Adebisi from the USA

Your Excellencies sirs,

I struggled against the temptation of criticizing your government in the early days of your administration for a number of reasons.

First and foremost, I happened to be one of the strong advocates and campaigners for your victory to become the President and Commander in Chief of the Federal Republic of Nigeria despite discouragements from many peers that tagged some of us as sellouts from the “aluta continua” team. I did not only campaign for you but I also traveled thousands of miles from the USA to my polling unit in Osogbo to cast my vote for you. Thus, for me now to be seen as one of your critics in this very early part of your administration by those that warned me against supporting you is a very bitter pill to swallow.

Secondly, I am a diehard progressive that always support any egalitarian government. I strongly believed that you would lead an egalitarian system of governance.

Sirs, I am one of the proud children of Uncle Bola Ige of blessed memories not because I happened to be his biological child but because his educational policies made me what I am today. This letter is being co-addressed to Baba Bisi Akande because he was part of the system of late Uncle Bola Ige that produced products like me, and he also played critical roles in your emergence as the President of the Federal Republic of Nigeria.

Without the egalitarian educational policies of Uncle Bola Ige and those of late Baba Obafemi Awolowo and his team, I would have most likely been a commercial driver today instead of being a proud black physician that treats white people in North America in this 21st century.

Sirs, I am originally from Osogbo, Osun State and I believe that there are still numerous Nigerian youths in Osogbo and other parts of Nigeria who share similar or worse humble socioeconomic root with me. I strongly believe that your favorable consideration of this letter of mine will save many Nigerian youths and youths of Osogbo from being left behind socio-economically.

Sirs, there is a triad that dictates socioeconomic fortune of any individual, and by extension, any community or nation. This triad comprises Poverty, Ignorance and Disease (PID). Among the ingredients of this socioeconomic triad, Ignorance is what is easy to control or prevent by deploying affordable and accessible quality education. Once Ignorance is addressed, the PID triad that mitigates against socioeconomic development is dismantled. This is the reason for this letter to implore you to focus more on affordable and accessible high-quality education during your administration sir.

If secondary and or tertiary education systems in Nigeria were commercialized in 1977 when I first completed primary school education and or in 1985 when I completed secondary school education, I would most likely not have had opportunity of becoming a physician even if this Student Loan Act of 2023 that you just signed into law had been in existence in those days for the following reasons:

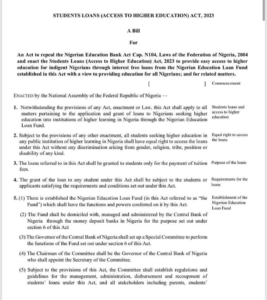

I have read that this Student Loan Act 2023 (hereinafter referred to as Act) is a prelude to your administration’s plan to stop or drastically reduce funding of public tertiary schools in Nigeria. While this rumor may remain speculative for now, the timing of this Act and its terms are very suspicious and concerning sirs.

When I first browsed through the terms of this Act, I thought that money that would be paid to each beneficiary would be a grant that would not be repaid back to the government. However, the caption that says “Student Loan” and the Sections that address the terms of repayment give me a lot of concerns based on my aforementioned socioeconomic pedigree as a medical student of Obafemi Awolowo University, Ile-Ife.

Specifically, Section 14 subsection (b) of the Act mandates that “applicant income or family income must be less than N500,000 per annum”.

annum”.

Sirs, as of today with the exchange rate of about N750 to one US dollar, N500,000 per annum is equivalent to just about $667 per annum. This means a child of any parents whose cumulative annual incomes are over N500,000 (or $667) per annum is prohibited from benefiting from this student loan. Such a child will end up dropping out of school if cost of education is beyond what his or her parents can afford.

In 1986 when I gained admission into the Obafemi Awolowo University to study medicine and surgery, the naira to US dollar exchange rate was about N2 to $1. This means $667 in 1986 was equivalent to about N1,333. I can say categorically that the cumulative incomes of my father and mother in 1986 were well above N1,333 per year and that I would not have qualified to apply for this Student Loan under this Act based on this criterion. Without access to loan, I would not have been able to afford attending Obafemi Awolowo University (OAU) to study Medicine and Surgery if I and or my parents had to pay school fees and other levies that would have been mandatory if the Federal Government of those days had refused to fund the OAU as a public university as being rumored that your administration is planning to do now.

Dividing N500,000 into 12 months would amount to about N42,000 per month as gross income or incomes for both father and mother of a candidate that can qualify for this loan sirs. This is about N21,000 per month for each of the two parents or N42,000 per month for single parent. We all know that N30,000 is the official minimum wage in Nigeria. A child of a security man or a cleaner or a maid or laborer that earns N50,000 per month is automatically disqualified from this Student Loan according to this subsection. This means large percentage of the children of the poor of the poorest Nigerians will not be able to qualify for this Student Loan sirs. If the children of poor Nigerians cannot qualify for Student Loan under this Act, what is the benefit of such loan then?

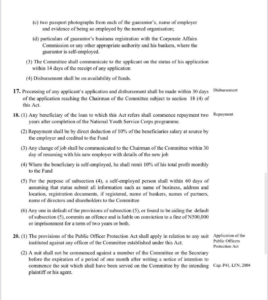

Subsection (c) of the same Section 14 of the Act also mandates that

“applicant must provide at least two guarantors, and each of the guarantors shall be a

(i) civil servant of at least level 12 in the service,

(in) lawyer with at least 10 years post-call experience,

(in) judicial officer, or

(iv) justice of peace.”

Sirs, we already know that a child that will qualify for this Student Loan under this Act must be from parents that are poorer than the poorest Nigerians on minimum wage of N30,000 per month per parent. The question is that how would such poor Nigerian that is not making up to minimum wage have the required network or connection to know relatively much richer Nigerians listed under Subsection (c) of Section 14 to the extent that at least two of these much richer Nigerians would stick out their necks to serve as guarantors who would be legally liable for whatever loan such poor child may collect in case he or she defaults from paying back the collected loan? This sounds like an impossible assignment or criterion that will make the loan application impossible to complete for many Nigerian youths. I am afraid that it will be almost impossible for a child of poor parents to be able to get much richer Nigerians to take such big risks for complete stranger without any strings attached. I am afraid that this condition will create unnecessary avenue for further exploiting already impoverished fellow Nigerians.

Sirs, unless the Act intends to make the proposed money a grant that is not to be repaid, Section 14 of the Act needs serious review. The guarantor criteria need to be changed to more feasible requirements. An example of such feasible requirement is what is obtainable in Student Loan process in the USA or Canada in which the applicant is allowed to serve as his or her own guarantor once he or she is above age of 18, or his or her parent or parents signing as the guarantor or guarantors if he or she is less than 18 years of age. It is then left to the Federal Government to set up credit system that ensures that the risk of defaulting is eliminated or significantly reduced.

Sirs, the annual/monthly income limit for the parents and or the applicant in the Act also needs to be rescinded or significantly reviewed upward to be commensurate with the existing economic situations in Nigeria. In a country where a bag of rice is selling for about N40,000, pegging income limit to N42,000 or less per month per family of a student loan’s beneficiary is impracticable. With the current socioeconomic situations in Nigeria, a child of parents that make N500,000 per month or N6,000,000 per year may still need student loan in order to be able to afford attending federal or state tertiary institution in the current Nigeria depending on many factors including, but not limited to, the number of other children such parents have, the cost of feeding the family per month, the cost of providing shelter for the family, the cost of taking care of the health of the family, the cost of addressing household needs and related expenses etc.

A practical example is a student that is admitted to Osun State University, which is owned by the government of Osun State, to study Medicine and Surgery. By the provisions of this Act, such student should qualify for this Student Loan being a state-owned university. However, the school fees alone for such 100 level student is about N704,000 according to the data at https://uniosun.edu.ng/schedule-of-fees/.

If parent or parents of such student is or are making N600,000 per year (about N50,000 per month), such student is automatically disqualified from applying for Student Loan under this Act even though the annual income of his or her parents is not enough to pay the school fees alone. How would such student not drop out of school for lack of fund despite this otherwise laudable Student Loan facility?

In other words, instead of focusing on the income of the candidate or parents of candidate in determining the eligibility for Student Loan, more efforts should be expended on modalities to ensure that beneficiary of such loan does not default from paying back the loan as soon as he or she is financially empowered to do so.

Lastly, Section 18 Subsection (1) of the Act mandates that “Any beneficiary of the loan to which this Act refers shall commence repayment two years after completion of the National Youth Service Corps programme” without making provisions for beneficiary that remainsunemployed two years after completing National Youth Service Corps programme (NYSC) and or a candidate that decides to further his or her education beyond the first degree level. Repayment of a Student loan like this should be deferred till the beneficiary completes his or her education and he or she is gainfully employed. Pegging the loan repayment commencement to two years post NYSC without factoring in numerous other situations that may make such early repayment non-feasible is an oversight of this Act that requires urgent attention as well.

In conclusion, while the efforts of this administration to establishing Student Loan programme in Nigeria are highly commendable, the Student Loan Act recently signed into law calls for urgent attentions as detailed above and the speculation that the current administration is planning to defund public tertiary institutions in Nigeria also needs to equally be urgently demystified.

Long live President Tinubu’s administration,

Long live Federal Republic of Nigeria.

Leave a Reply